Competitiveness

This article is about the economic and econometric sense of the word.

.

Competitiveness pertains to the ability and performance of a firm, sub-sector or country to sell and supply goods and services in a given market, in relation to the ability and performance of other firms, sub-sectors or countries in the same market.Firm competitiveness

Empirical observation confirms that resources (capital, labor, technology) and talent tend to concentrate geographically (Easterly and Levine 2002). This result reflects the fact that firms are embedded in inter-firm relationships with networks of suppliers, buyers and even competitors that help them to gain competitive advantages in the sale of its products and services. While arms-length market relationships do provide these benefits, at times there are externalities that arise from linkages among firms in a geographic area or in a specific industry (textiles, leather goods, silicon chips) that cannot be captured or fostered by markets alone. The process of “clusterization,” the creation of “value chains,” or “industrial districts” are models that highlight the advantages of networks.Within capitalist economic systems, the drive of enterprises is to maintain and improve their own competitiveness, this practically pertains to business sectors.

National competitiveness

Global Competitiveness Index (2008–2009): competitiveness is an important determinant for the well-being of states in an international trade environment.

The term is also used to refer in a broader sense to the economic competitiveness of countries, regions or cities. Recently, countries are increasingly looking at their competitiveness on global markets. Ireland (1997), Saudi Arabia (2000), Greece (2003), Croatia (2004), Bahrain (2005), the Philippines (2006), Guyana, the Dominican Republic and Spain (2011) [2] are just some examples of countries that have advisory bodies or special government agencies that tackle competitiveness issues. Even regions or cities, such as Dubai or the Basque Country(Spain), are considering the establishment of such a body.

The institutional model applied in the case of National Competitiveness Programs (NCP) varies from country to country, however, there are some common features. The leadership structure of NCPs relies on strong support from the highest level of political authority. High-level support provides credibility with the appropriate actors in the private sector. Usually, the council or governing body will have a designated public sector leader (president, vice-president or minister) and a co-president drawn from the private sector. Notwithstanding the public sector’s role in strategy formulation, oversight, and implementation, national competitiveness programs should have strong, dynamic leadership from the private sector at all levels – national, local and firm. From the outset, the program must provide a clear diagnostic of the problems facing the economy and a compelling vision that appeals to a broad set of actors who are willing to seek change and implement an outward-oriented growth strategy. Finally, most programs share a common view on the importance of networks of firms or “clusters” as an organizing principal for collective action. Based on a bottom-up approach, programs that support the association among private business leadership, civil society organizations, public institutions and political leadership can better identify barriers to competitiveness; develop joint-decisions on strategic policies and investments; and yield better results in implementation.

National competitiveness is said to be particularly important for small open economies, which rely on trade, and typically foreign direct investment, to provide the scale necessary for productivity increases to drive increases in living standards. The Irish National Competitiveness Council uses a Competitiveness Pyramid structure to simplify the factors that affect national competitiveness. It distinguishes in particular between policy inputs in relation to the business environment, the physical infrastructure and the knowledge infrastructure and the essential conditions of competitiveness that good policy inputs create, including business performance metrics, productivity, labour supply and prices/costs for business.

Competitiveness is important for any economy that must rely on international trade to balance import of energy and raw materials. The European Union (EU) has enshrined industrial research and technological development (R&D) in her Treaty in order to become more competitive. In 2009, €12 billion of the EU budget [3] (totalling €133.8 billion) will go on projects to boost Europe's competitiveness. The way for the EU to face competitiveness is to invest in education, research, innovation and technological infrastructures.[4][5]

The International Economic Development Council (IEDC) [6] in Washington, D.C. published the "Innovation Agenda: A Policy Statement on American Competitiveness". This paper summarizes the ideas expressed at the 2007 IEDC Federal Forum and provides policy recommendations for both economic developers and federal policy makers that aim to ensure America remains globally competitive in light of current domestic and international challenges.[7]

International comparisons of national competitiveness are conducted by the World Economic Forum, in its Global Competitiveness Report, and the Institute for Management Development,[8] in its World Competitiveness Yearbook.[9]

Scholarly analyses of national competitiveness have largely been qualitatively descriptive.[10] Systematic efforts by academics to define meaningfully and to quantitatively analyze national competitiveness have been made,[11] with the determinants of national competitiveness econometrically modeled.[12]

A US government sponsored program under the Reagan administration called Project Socrates, was initiated to, 1) determine why US competitiveness was declining, 2) create a solution to restore US competitiveness. The Socrates Team headed by Michael Sekora, a physicist, built an all-source intelligence system to research all competitiveness of mankind from the beginning of time. The research resulted in ten findings which served as the framework for the "Socrates Competitive Strategy System". Among the ten finding on competitiveness was that 'the source of all competitive advantage is the ability to access and utilize technology to satisfy one or more customer needs better than competitors, where technology is defined as any use of science to achieve a function".[13]

Role of infrastructure investments

Some development economists believe that a sizeable part of Western Europe has now fallen behind the most dynamic amongst Asia’s emerging nations, notably because the latter adopted policies more propitious to long-term investments: “Successful countries such as Singapore, Indonesia and South Korea still remember the harsh adjustment mechanisms imposed abruptly upon them by the IMF and World Bank during the 1997–1998 ‘Asian Crisis’ […] What they have achieved in the past 10 years is all the more remarkable: they have quietly abandoned the "Washington consensus" [the dominant Neoclassical perspective] by investing massively in infrastructure projects […] this pragmatic approach proved to be very successful.”[14]The relative advancement of a nation’s transportation infrastructure can be measured using indices such as the (Modified) Rail Transportation Infrastructure Index (M-RTI or simply ‘RTI’) combining cost-efficiency and average speed metrics [15]

Trade Competitiveness

While competitiveness is understood at a macro-scale, as a measure of a country's advantage or disadvantage in selling its products in international markets. Trade competitiveness can be defined as the ability of a firm, industry, city, state or country, to export more in value added terms than it imports.Using a simple concept to measure heights that firms can climb may help improve execution of strategies. International competitiveness can be measured on several criteria but few are as flexible and versatile to be applied across levels as Trade Competitiveness Index (TCI).[16]

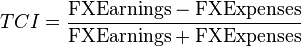

Trade Competitiveness Index (TCI)

TCI can be formulated as ratio of forex (FX) balance to total forex as given in equation below. It can be used as a proxy to determine health of foreign trade, .The ratio from -1 to 1; higher ratio being indicative of higher international trade competitiveness.Criticism

Krugman (1994) points to the ways in which calls for greater national competitiveness frequently mask intellectual confusion arguing that, in the context of countries, productivity is what matters and "the world's leading nations are not, to any important degree, in economic competition with each other." Krugman warns that thinking in terms of competitiveness could lead to wasteful spending, protectionism, trade wars, and bad policy.[17] As Krugman puts it in his crisp, aggressive style "So if you hear someone say something along the lines of ‘America needs higher productivity so that it can compete in today’s global economy’, never mind who he is, or how plausible he sounds. He might as well be wearing a flashing neon sign that reads: ‘I don’t know what I’m talking about’."If the concept of national competitiveness has any substantive meaning it must reside in the factors about a nation that facilitate productivity, and alongside criticism of nebulous and erroneous conceptions of national competitiveness systematic and rigorous attempts like Thompson’s [11] need to be elaborated.

Post A Comment:

0 comments: